CryptoDash Tools

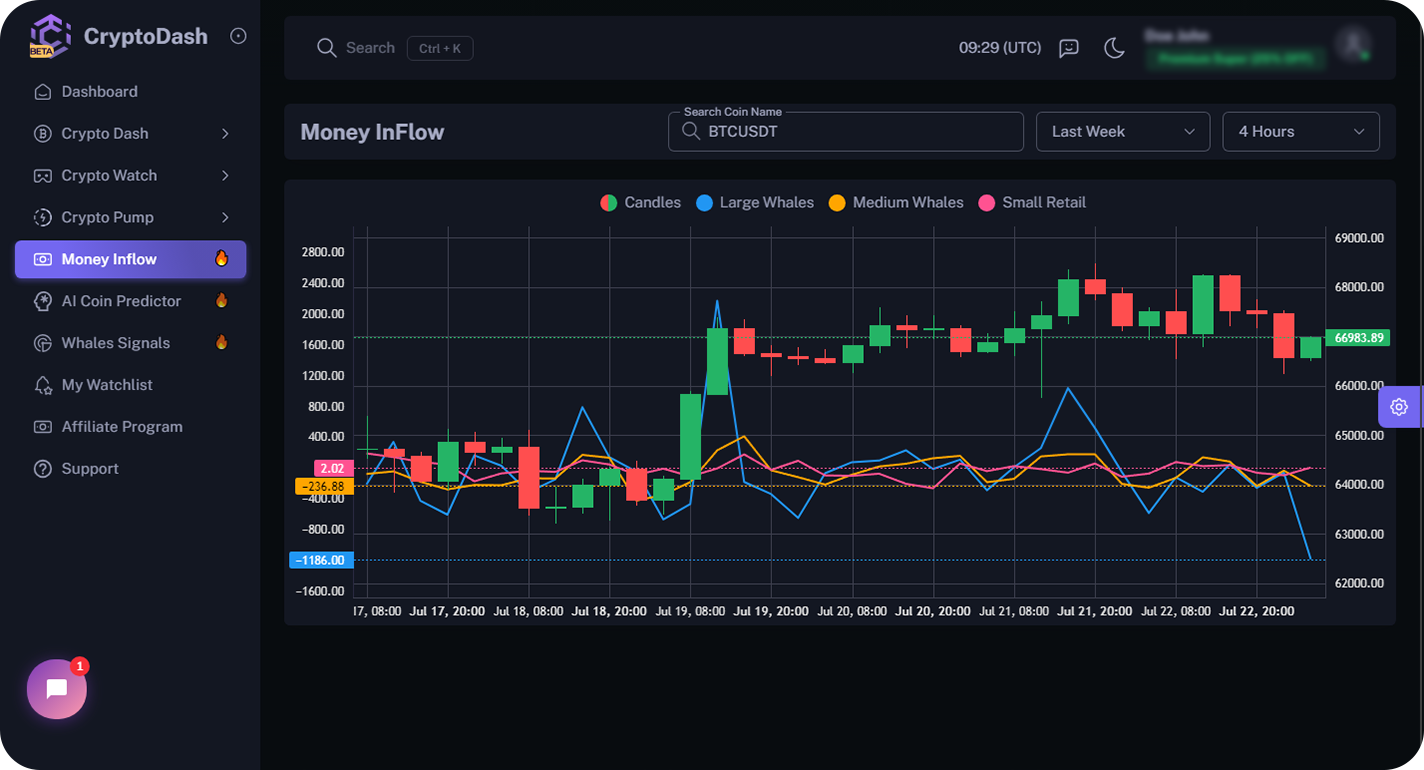

Money Inflow , Provides data on the flow of fiat currency into the cryptocurrency market over a specific timeframe. It tracks the volume and movement of money from traditional banking systems or payment gateways into cryptocurrency exchanges or platforms. Money inflow data helps traders and investors understand the level of interest and investment from fiat currency holders into the cryptocurrency market. By analyzing money inflow trends, users can gain insights into market sentiment, liquidity levels, and potential shifts in investor behavior.

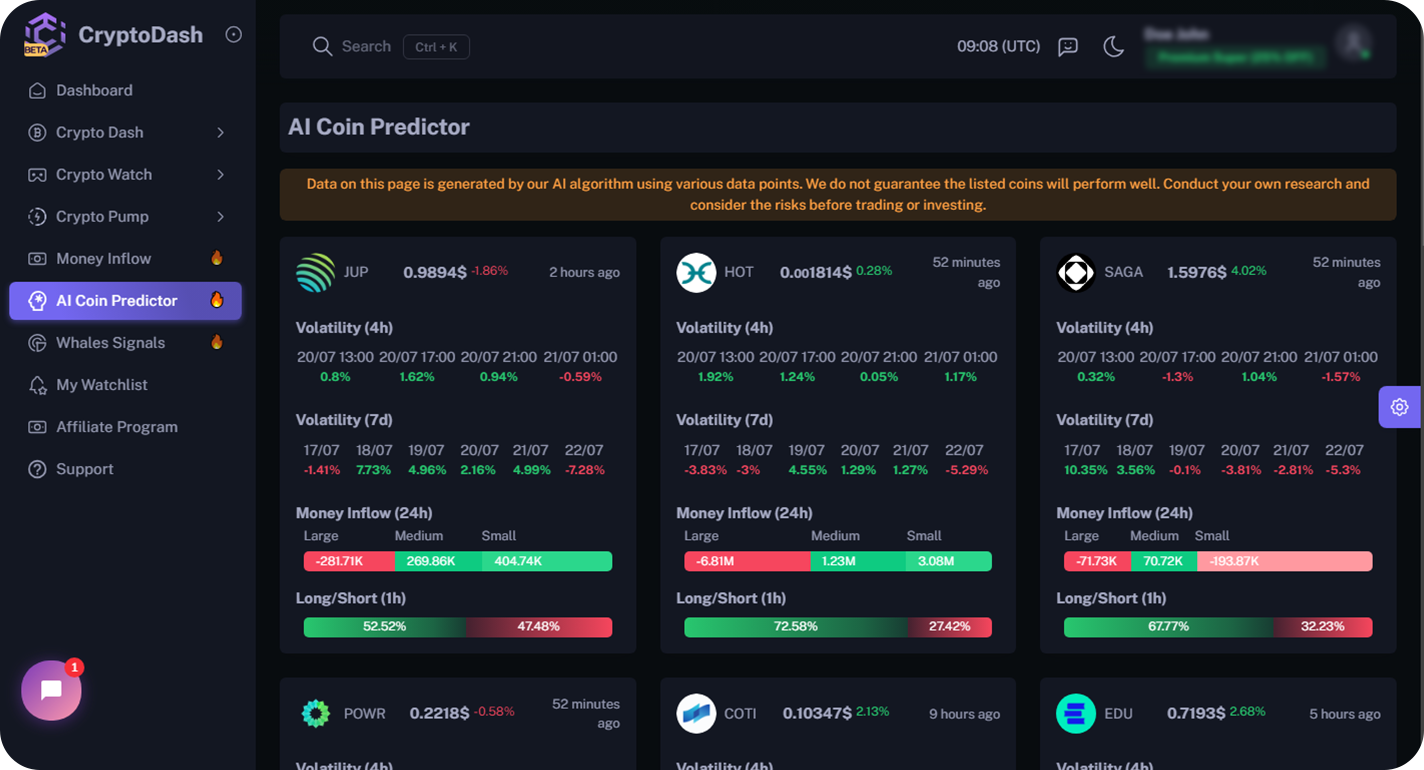

AI Coin Predictor , Provides advanced predictive analytics for cryptocurrency price movements using artificial intelligence and machine learning algorithms. The AI Coin Predictor forecasts future price trends based on historical data, market sentiment, and various technical indicators. By analyzing these factors, users can gain insights into potential market movements, helping traders and investors make informed decisions. This tool enhances users' ability to anticipate price changes, optimize their trading strategies, and navigate the cryptocurrency market with greater confidence.

Whales Signals , Provides insights into the trading activities of large cryptocurrency holders, often referred to as "whales." The Whales Signals tool tracks significant transactions and movements of large amounts of cryptocurrency, helping traders and investors understand the actions of these influential market participants. By analyzing whale activities, users can gain insights into potential market movements, anticipate price fluctuations, and make informed trading decisions. This tool enhances users' ability to react to market changes driven by large transactions and optimize their trading strategies accordingly.

Whales Watch , Provides detailed insights into the daily accumulation patterns of large cryptocurrency holders, known as "whales." The Whales Watch - Daily Coins Accumulation tool tracks the increase in holdings of significant investors, helping traders and investors understand the accumulation trends and potential market impact of whale activities. By analyzing these patterns, users can gain insights into market sentiment, anticipate potential price movements, and make informed trading decisions. This tool enhances users' ability to react to market changes driven by whale accumulation and optimize their trading strategies accordingly.

Volatility Watch , Provides comprehensive data on the weekly price fluctuations of cryptocurrencies. The Volatility Watch - Weekly Price Variation tool tracks and analyzes the extent of price variation over a week, helping traders and investors understand the volatility levels of different cryptocurrencies. By analyzing these variations, users can gain insights into market behavior, anticipate potential price movements, and make informed trading decisions. This tool enhances users' ability to react to changes in market dynamics driven by price volatility and optimize their trading strategies accordingly.

Scalping Watch , Provides real-time data and analysis on short-term price movements, specifically designed to assist traders using scalping strategies. The Scalping Watch tool helps users identify quick trading opportunities by tracking live price movements, analyzing short-term trends, and providing rapid updates. By utilizing this tool, traders can capitalize on small price fluctuations in the cryptocurrency market, making informed decisions for quick trades. This tool enhances users' ability to execute effective scalping strategies, optimizing their trading performance.

Open Interest Watch , Provides comprehensive insights into the open interest levels of various cryptocurrency futures and options contracts. The Open Interest Watch tool monitors the total number of outstanding derivative contracts, helping traders and investors understand market participation and sentiment. By analyzing open interest trends, users can gain insights into potential price movements and market shifts, making informed trading decisions. This tool enhances users' ability to anticipate market dynamics based on open interest data and optimize their trading strategies accordingly.

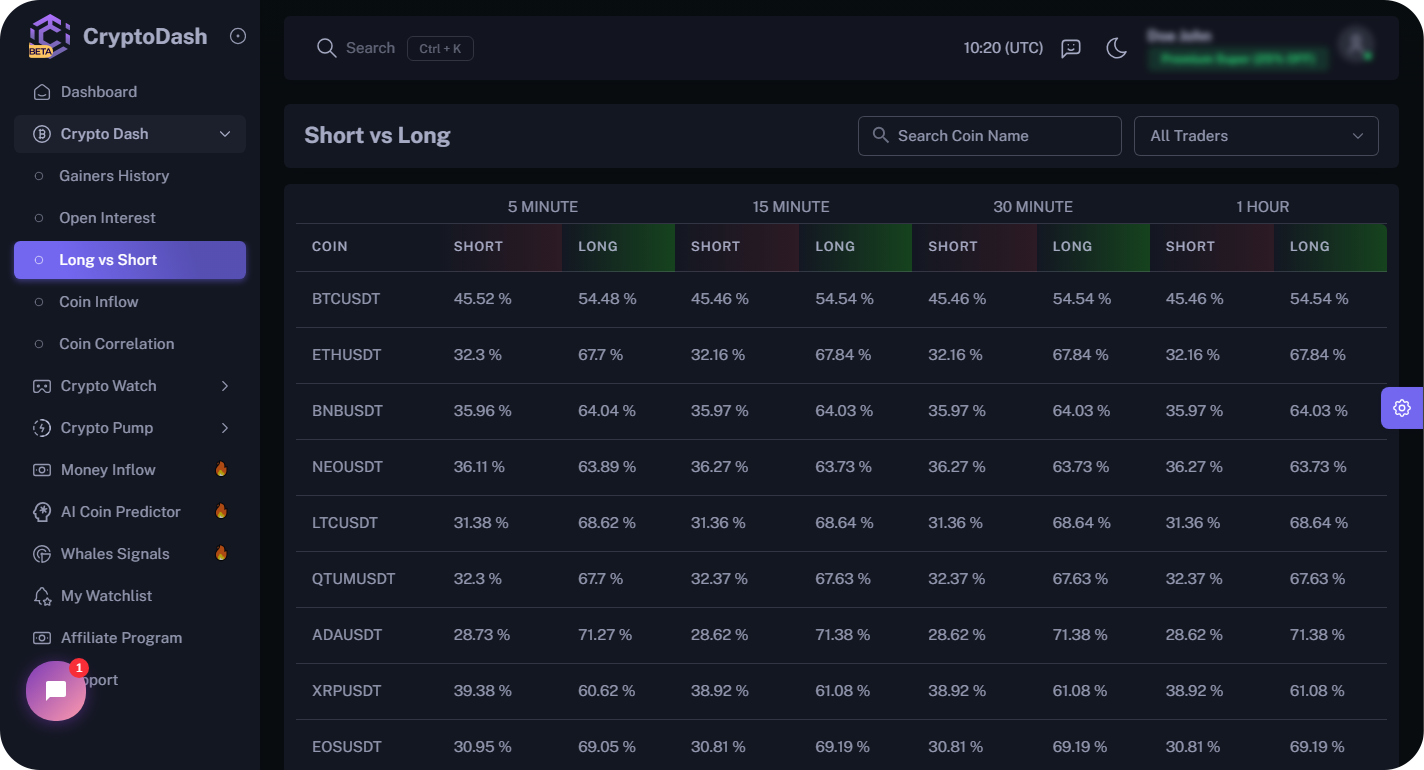

Short vs Long , Provides a detailed analysis of the balance between short and long positions in the cryptocurrency market. The Short vs Long tool tracks and compares the volume of short and long trades, helping traders and investors understand market sentiment and potential future price movements. By analyzing the ratio of short to long positions, users can gain insights into whether the market is predominantly bearish or bullish, making informed trading decisions. This tool enhances users' ability to anticipate market dynamics based on the balance of short and long positions and optimize their trading strategies accordingly.

Subscribe now for exclusive insights and tools.

Join us now